Title: The Psychology Behind Investing: Understanding Human Behavior in Financial Markets

Investing is often seen through the lens of numbers, charts, and financial analysis. However, beneath the surface, the decisions investors make are heavily influenced by psychology. Understanding the psychological factors that drive investment behaviors can provide valuable insights into market fluctuations and individual decision-making processes. In this article, we will explore some of the key psychological concepts that play a role in investing and how they impact both amateur and professional investors.

1. Behavioral Finance: A Brief Overview

Behavioral finance is a field that combines psychology and economics to explain why investors sometimes make irrational financial decisions. Unlike traditional finance theories that assume investors are always rational and markets are always efficient, behavioral finance acknowledges that cognitive biases and emotions can lead to illogical decisions and market inefficiencies.

2. Common Psychological Biases in Investing

Several cognitive biases can significantly influence investment decisions. Here are a few prominent ones:

-

Overconfidence Bias: Investors often overestimate their knowledge or ability to predict market movements, leading them to take excessive risks. Overconfidence can result in frequent trading, inadequate diversification, and ultimately, poorer financial performance.

-

Confirmation Bias: Investors have a tendency to seek out information that confirms their pre-existing beliefs while ignoring or downplaying contradictory data. This bias can lead to maintaining poor investment strategies or holding onto losing stocks.

-

Loss Aversion: Coined by psychologists Daniel Kahneman and Amos Tversky, loss aversion refers to the tendency for individuals to prefer avoiding losses rather than acquiring equivalent gains. This can cause investors to react irrationally to negative news or market downturns, sometimes leading to panic selling.

- Herd Mentality: Social influence can lead investors to follow the crowd, often resulting in buying high during market euphoria or selling low during market panic. This can create bubbles and crashes, significantly affecting market stability.

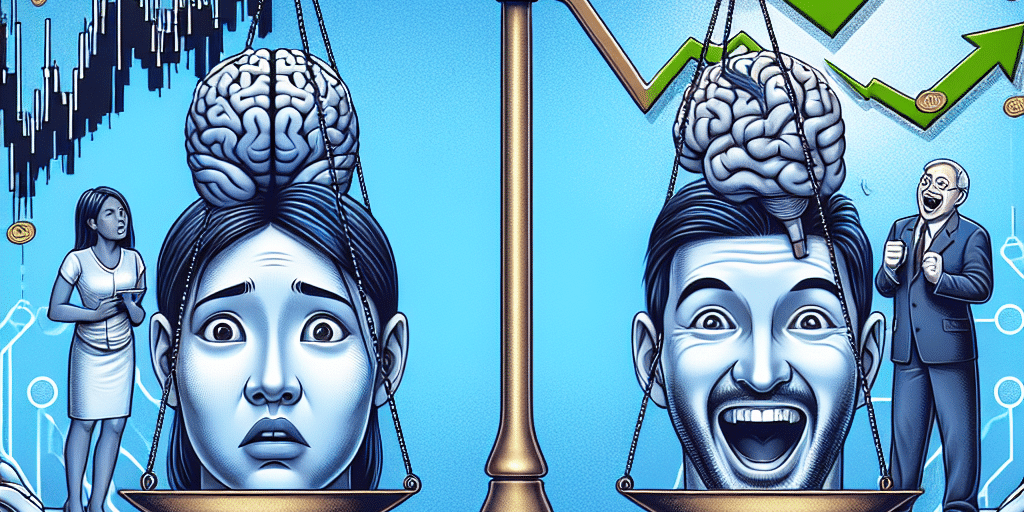

3. Emotional Influences on Investment Decisions

Emotions play a critical role in influencing investment decisions. Fear and greed are often cited as the two dominant emotions in financial markets.

-

Fear: During market downturns or economic uncertainties, fear can cause investors to abandon their long-term strategies in favor of rash, short-term decisions. This often results in selling off assets at a loss, only to miss out on potential recoveries.

- Greed: In bullish markets, the desire for wealth can drive investors to take on greater risks, chasing after high returns without adequately considering the potential downsides. This can lead to asset bubbles and subsequent market corrections.

4. Strategies to Mitigate Psychological Biases

Awareness of psychological factors is the first step in mitigating their impact on investment decisions. Here are some strategies to help manage these biases:

-

Diversification: By spread investments across various asset classes and geographies, investors can reduce the risk of massive losses from a single investment.

-

Setting Clear Goals: Establishing specific, measurable, and time-bound financial goals can provide a roadmap and reduce emotional decision-making.

-

Regular Portfolio Review: Periodic evaluation of the investment portfolio can help ensure it remains aligned with the investor’s goals and risk tolerance.

-

Seeking Professional Advice: Financial advisors can offer objective perspectives, free from the emotional ties that individual investors may have to their portfolios.

- Mindfulness and Emotional Regulation: Developing mindfulness practices and emotional regulation skills can help investors remain calm and make more rational decisions during periods of market volatility.

Conclusion

Investing is as much an art influenced by human behavior as it is a science grounded in financial principles. By understanding the psychological underpinnings of investment decisions, investors can better navigate the challenges and opportunities in financial markets. While it may not be possible to completely eliminate emotional and cognitive biases, awareness and proactive management can lead to more informed and rational investment choices. As markets continue to evolve, the intersection of psychology and investing remains a crucial area for both academic exploration and practical application.