Art Investment Explained: Turning Passion into Profit

By [Your Name]

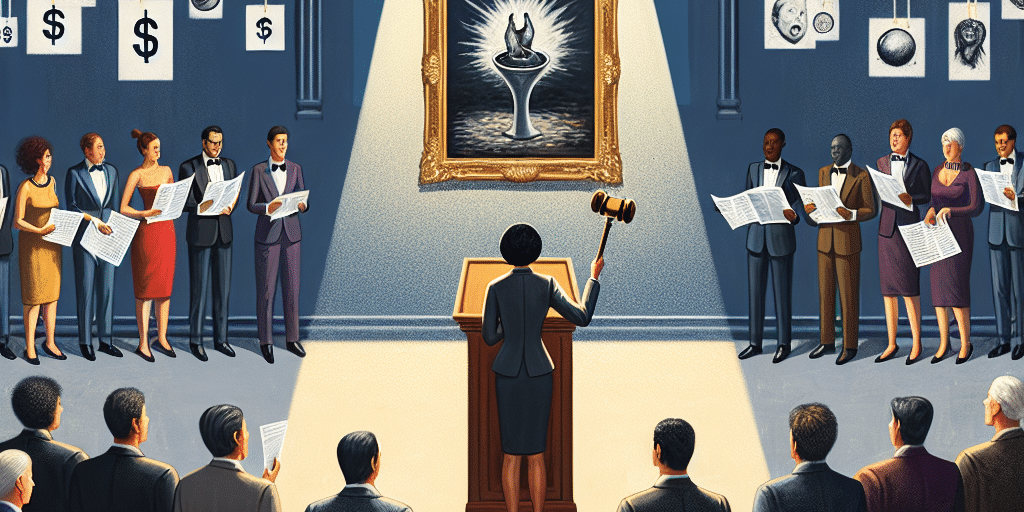

Investing in art has long been perceived as a pursuit reserved for the wealthy elite or the creatively inclined. However, the landscape of art investment is evolving, offering opportunities to a broader audience keen to turn their passion for aesthetics into financial gain. This article will delve into the fundamentals of art investment, its benefits, potential risks, and how to get started.

Understanding Art Investment

At its core, art investment involves purchasing artworks with the expectation that they will appreciate in value over time. Unlike stocks or bonds, art is a tangible asset, allowing investors to enjoy the physical beauty and cultural significance of their investment while it potentially appreciates.

Why Invest in Art?

Diversification: Art provides an alternative asset class that can diversify an investment portfolio. The performance of art markets tends not to correlate directly with traditional financial markets, offering a hedge against economic volatility.

Cultural and Aesthetic Value: Unlike other investments, art offers intrinsic enjoyment. Collectors derive satisfaction from owning and displaying beautiful and culturally significant pieces.

Potential Appreciation: Some artworks appreciate significantly over time, and notable pieces by renowned artists can yield substantial returns. Historical data shows that blue-chip art (works by highly established artists) can generate comparable returns to stock markets over the long term.

- Status Symbol: Owning high-value art can also confer social prestige and recognition within certain circles.

Risks and Challenges

Market Volatility: The art market can be unpredictable. The value of art can be highly subjective and influenced by trends, the artist’s reputation, provenance, and even the economy.

Liquidity Issues: Art is not as liquid as stocks or bonds. Selling a piece of art can be time-consuming and may not always yield the desired price.

High Transaction Costs: Acquiring and selling art involves significant transaction costs, including auction house fees, insurance, storage, and maintenance costs.

- Forgery and Authenticity Risks: The art market is rife with fakes and forgeries. It’s critical to ensure the authenticity of a piece before investing.

How to Start Investing in Art

Educate Yourself: Knowledge is your best asset in the art market. Attend exhibitions, read art investment books, follow art market news, and consider taking courses on art history and valuation.

Set a Budget: Determine how much you’re willing to invest. Art investments can range from a few hundred dollars to millions. Start within your financial comfort zone and gradually expand as you gain experience.

Seek Expert Advice: Engage with art advisors or consultants who have knowledge and experience in the art market. They can guide you on valuations, authenticity, and market trends.

Buy What You Love: While investment potential is crucial, it’s equally important to buy art that you appreciate and enjoy. This ensures you derive satisfaction from your collection, regardless of its financial performance.

Consider Different Market Segments: The art market is vast and segmented into various categories, such as contemporary, modern, classical, and emerging artists. Diversifying within the art market can mitigate risks.

Understand Provenance and Documentation: Provenance, or the history of ownership, is critical in assessing an artwork’s authenticity and value. Ensure that the piece comes with proper documentation.

- Leverage Art Funds and Platforms: If you prefer not to select artworks personally, consider art investment funds or platforms that aggregate investments to purchase art collections, offering a diversified exposure to the art market.

Conclusion

Art investment combines financial foresight with cultural appreciation, providing a unique avenue to potentially grow wealth while indulging a passion for creativity. As with any investment, success requires thorough research, strategic planning, and expert advice. For those willing to navigate its complexities, art investment offers a rewarding opportunity to turn passion into profit.