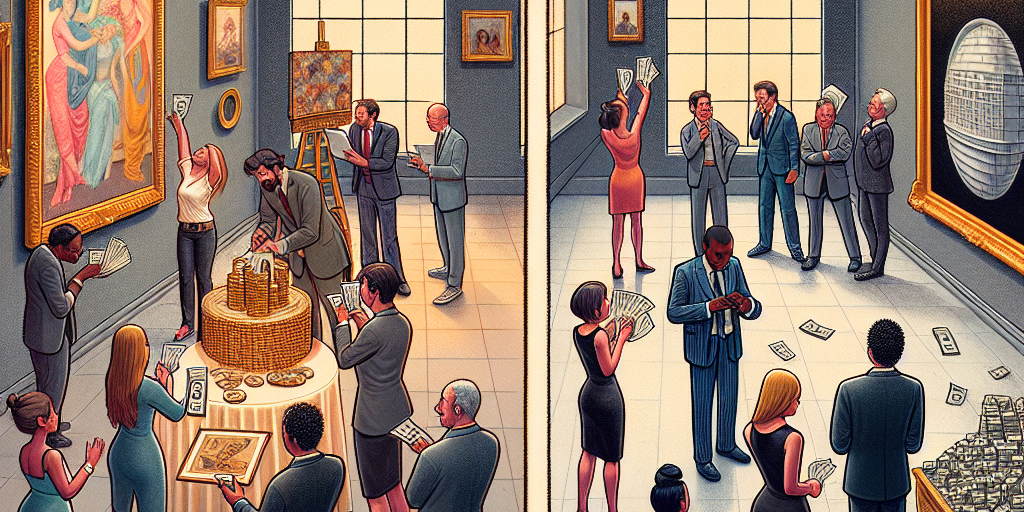

Art investment can be a lucrative venture for those looking to diversify their investment portfolio. With the art market booming, many people are looking to capitalize on the potential for high returns. However, it is important to proceed with caution and be mindful of the do’s and don’ts of art investment to ensure success.

Do’s:

1. Research the market: Before diving into art investment, it is crucial to research the market and understand the trends and prices of different artists and styles. This will help you make informed decisions and identify potential opportunities for investment.

2. Buy what you love: While it is important to consider the potential for appreciation in value, it is equally important to invest in art that you love and appreciate. This will not only make the investment more enjoyable, but also reduce the risk of making hasty decisions based solely on financial gains.

3. Seek professional advice: If you are new to art investment, consider consulting with a professional art advisor or financial planner who specializes in art investment. They can provide valuable insights and guidance to help you make informed decisions.

4. Diversify your portfolio: Just like with any investment, diversification is key to minimizing risk. Consider investing in a variety of artists, styles, and mediums to spread out your risk and increase the potential for returns.

Don’ts:

1. Don’t rush into decisions: Art investment requires careful consideration and due diligence. Avoid making impulsive decisions based on emotions or short-term trends. Take your time to research and evaluate potential opportunities before making a purchase.

2. Don’t overlook authenticity and provenance: When investing in art, it is crucial to ensure that the artwork is authentic and comes with proper documentation of provenance. Buying art with questionable authenticity can lead to legal issues and financial losses down the line.

3. Don’t overlook maintenance and storage: Artwork requires proper maintenance and storage to preserve its value over time. Make sure to factor in the cost of maintaining and storing your art collection when evaluating potential investments.

4. Don’t solely focus on financial gains: While the potential for high returns may be a motivating factor in art investment, it is important to also consider the cultural and emotional value of the artwork. Investing solely for financial gains may lead to disappointment if the market trends change.

In conclusion, art investment can be a rewarding and profitable venture when approached with caution and diligence. By following the do’s and don’ts of art investment, investors can maximize their potential for success and enjoyment in the art market. Remember to research, diversify, seek professional advice, and invest in what you love to make the most of your art investment journey.